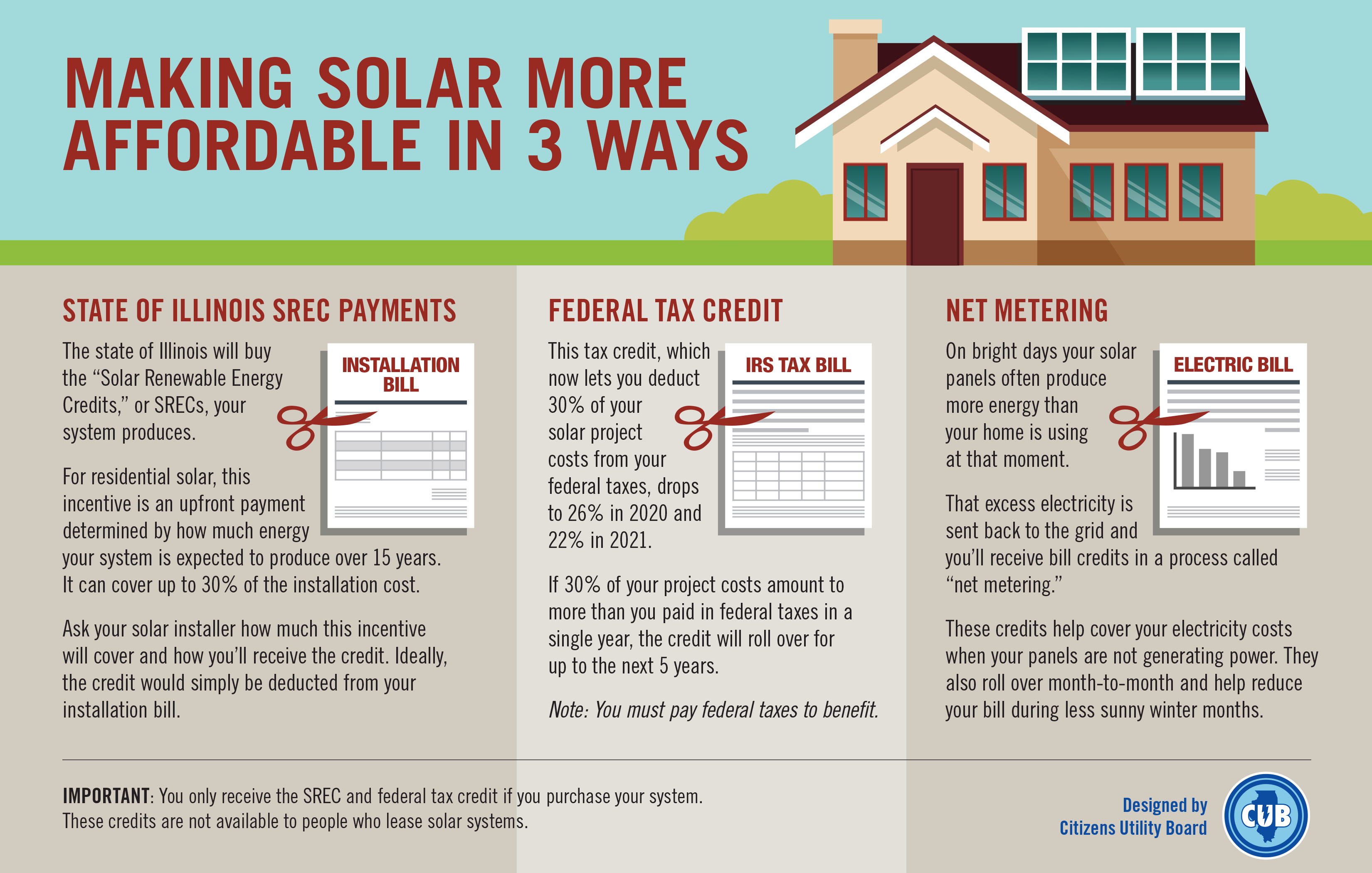

Illinois Subsidies For Solar Panels

Learn more about tax exemptions for solar.

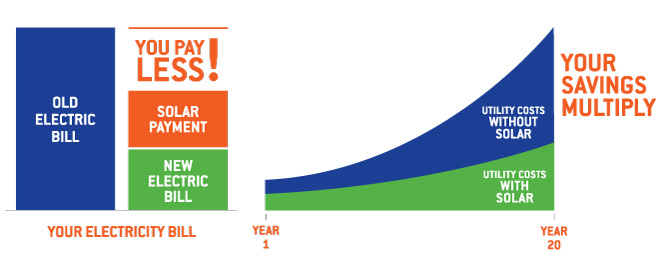

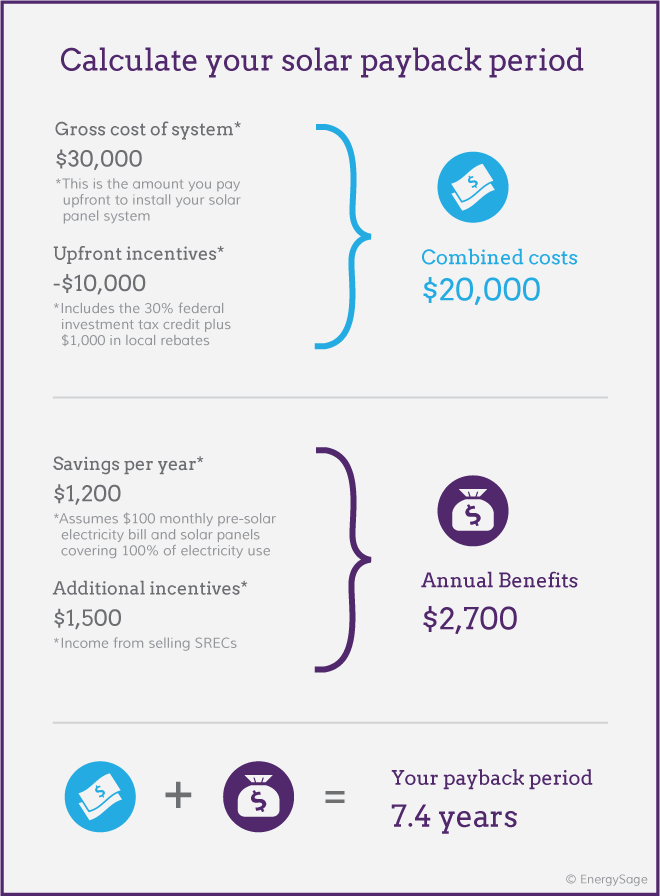

Illinois subsidies for solar panels. When a claim for alternate valuation is filed the chief county assessment officer is required to ascertain two values. For solar energy the first major step illinois took to encourage installations was to pass the special assessment for solar energy systems in 1998. An average sized residential solar system about 400 square feet of solar panels costs 18 000 according to the solar energy industries association an industry group. Illinois renewable portfolio standard rps means the state is committed to producing.

The tax break reduces. The bill which remains available today provides a property tax easement by equating the solar equipment to be valued at no more than the value of a conventional energy system. The adjustable block program. Other states do offer a 100 sales tax exemption and illinois even offers the exemption for wind energy installations so the legislature needs to catch up here.

Comed commercial solar rebates. Illinois offers a special assessment of solar energy systems for property tax purposes. The value of the improvements as if equipped with a conventional heating or cooling system and the value of the improvements as equipped with the solar energy system. Solar power performance payments provide small cash payments based on the number of kilowatt hours kwh or btus generated by a renewable energy system.